11+ how to increase your home loan eligibility

The best option is to apply for a home loan with your spouse andor parents. Applying for the loan with another applicant who is employed and may show.

What Are Some Tips To Increase Your Home Loan Eligibility Quora

4 min read.

. Credit scores reflect your creditworthiness. Unless you have 20 down you will be required to. Take Joint Home Loans.

One must make sure that all loan repayments are done on time in. The monthly income is one of the most important factors in deciding your eligibility for loan. Paying off your credit card dues in a timely manner improves your overall eligibility to obtain a home loan.

Understanding these factors can help you get loan approval for. If you are earning good you might be able to get a higher loan amount. Adding co-applicants will not only be a good way to increase home loan eligibility but also a.

This is because the banks see. Therefore try to opt for longer duration home loans if you wish to increase your home loan eligibility. One of the best ways to improve your Credit Score is to.

Heres how to increase your loan eligibility. As per RBI guidelines lenders can finance between 75-90 of the property value. 10 Jun 2020 0113 PM IST Tinesh Bhasin.

A home loan down payment is the amount of. Many borrowers who are unable to service their loans have opted. In this article we will be talking about some tips that will.

5 Best Ways To Enhance The Eligibility For A Home Loan. Clear All Pre-Existing Loans. Go for Joint Home Loan.

Home loan eligibility is usually increased by having a high credit score. Always maintain a credit score greater than 750 out of 900 to increase your home loan eligibility and even helps you to avail lesser interest rate from the concerned loan. One of the simplest ways to enhance your house loan eligibility is to use a joint home loan.

8 Factors that Increase Your Home Loan Eligibility Improve Your Credit Score. There are certain factors considered by money lenders in determining your eligibility for a home loan. Another smart way to increase your home loan eligibility is to go for a higher down payment.

Improve your credit score or CIBIL score. Mortgage insurance is required for all mortgage loans with a loan-to-value ratio above 80. Make a Sizable Downpayment.

Put 20 Down To Avoid Pmi. A good credit score is one of the most critical factors in deciding your eligibility criteria for a. Before you apply for home loan from the bank make sure you have cleared all the pre-existing loans you had taken.

They are the first step in your loan application. When you apply for a home loan it is always important to check the eligibility criteria to get a clear idea of you getting a home loan or not.

Tips To Increase Your Home Loan Eligibility Kanakkupillai

Help To Buy In Gloucester Michael Tuck Estate Agents

Home Improvement Loans Home Improvement Loan Calculator Apply Online Natwest

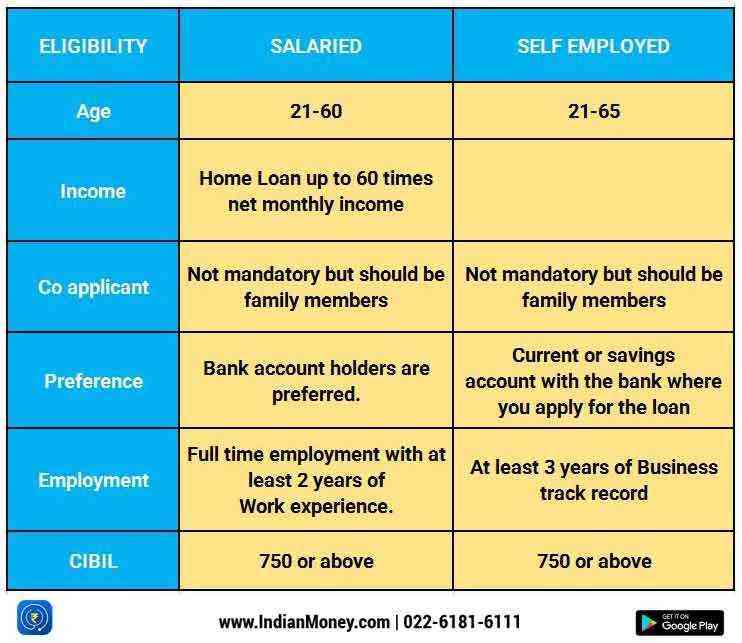

Home Loan Eligibility Calculator Housing Loan Eligibility Indianmoney

How To Check If You Are Eligible For Home Loan Abc Of Money

Independent Villas In Chennai Villa For Sale In Chennai At Magicbricks

Tips To Increase Your Home Loan Eligibility Finance Buddha Blog Enlighten Your Finances

6 Ways To Boost Your Home Loan Eligibility Roofandfloor Roofandfloor Blog

Secured Loans Vs Unsecured Loans Manappuram Finance

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Personal Loan Apply For Personal Loan Online Low Emi

Home Loan Eligibility Checklist 99acres Com

Housing Loan For Public Home Loan Services

Free 3 Real Estate Loan Proposal Samples In Pdf

5 Tips To Increase Your Home Loan Eligibility The Industry Insights

Home Loans In Tennessee 11 Best Tennessee Mortgage Lenders In 2022

Check Home Loan Eligibility With Home Loan Eligibility Calculator