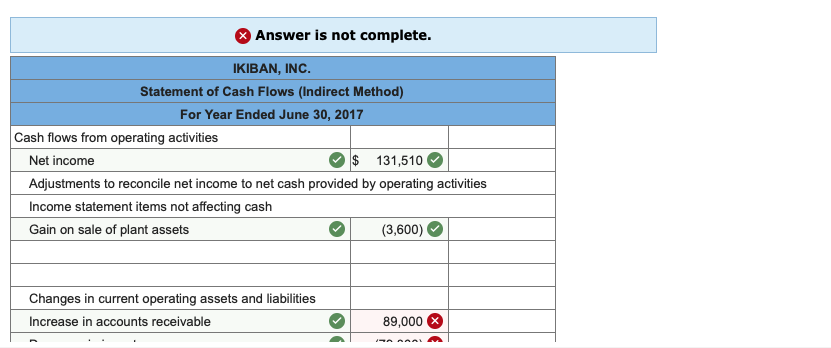

53+ the cash flow on total assets ratio is calculated by

Multiple Choice Dividing average total assets by cash flows from financing activities. Assume that a corporation had net cash provided by operating activities of 200000 and had capital expenditures of 140000.

Operating Cash Flow To Total Assets

You can calculate their value this way.

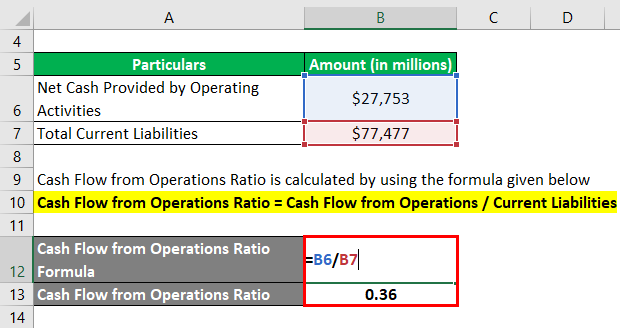

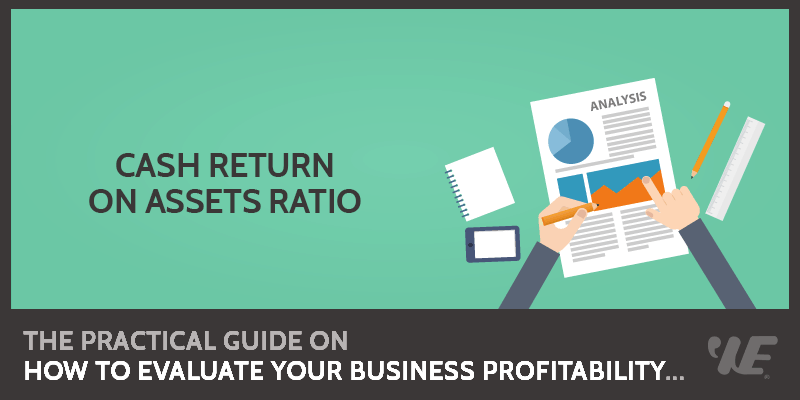

. The corporations free cash flow is. Web Calculated as operating cash flows divided by total debt. Web The cash flow on total assets ratio is calculated by dividing cash flows from operations by the average total assets.

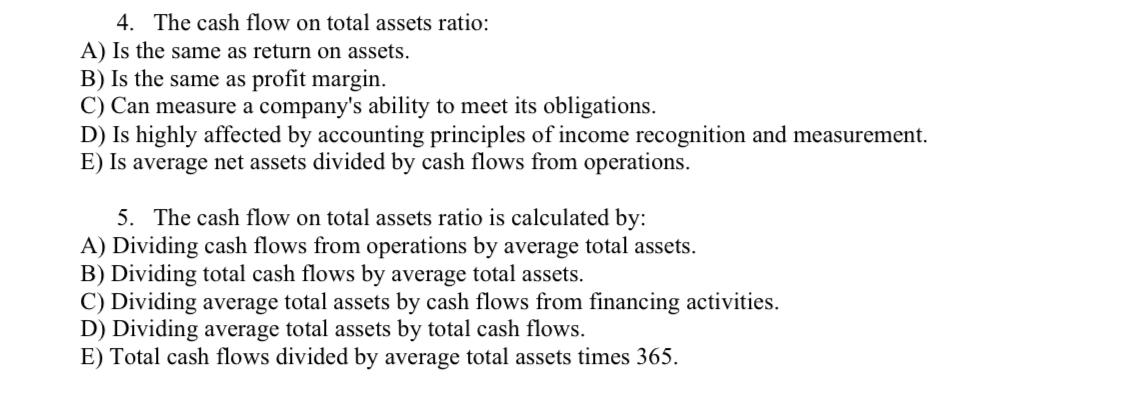

Web Cash flow on total assets ratio shows how a business uses its assets to generate cash flow so you can determine its profitability and efficiency. A Dividing cash flows from operations by average total assets B Dividing total cash flows by average total assets C Dividing average total assets by cash flows from investing activities D Dividing average total assets by total cash flows. Example The cash flow to total asset ratio is most often.

This means that 45 percent of every dollar of its assets is financed by borrowed money. Because higher ratios typically indicate that a company is effectively using its assets to generate. Web The cash flow on total assets ratio is calculated by.

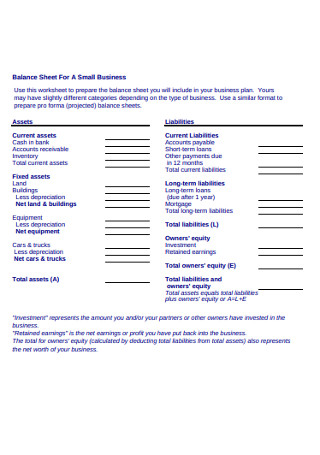

You can calculate the average total assets by summing the beginning and ending total assets and. Web For example a small business has a debt to asset ratio of 45 percent. Total cash flows divided by.

Web The cash flow on total assets ratio is calculated by. Quick assets cash cash equivalents marketable. Web Total Assets 5833 The higher the return on assets ratio the better.

Web Cash Return on Total Assets Ratio Operating Cash Flow Average Total Assets. The resulting number would be your cash. This ratio should be as high as possible which indicates that an organization has sufficient cash flow to.

Web Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance. Web So to calculate it divide the operating cash flow by the average value of assets in a company for a particular year. Web Quick assets are a subset of the companys current assets.

Web Cash Flow from Operations Ratio is the ratio that helps in measuring the adequacy of the cash which are generated by the operating activities that can cover its current liabilities.

Understanding Cash Flow On Total Assets Ratio Youtube

Answered Cash Flow On Total Assets Ratio Is Bartleby

Liquidity Ratio Nwc To Assets Ratio Youtube

Solved 4 The Cash Flow On Total Assets Ratio A Is The Chegg Com

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Consumer Analyst Group Of New York Cagny Conference 2023

50 Sample Balance Sheets In Pdf Ms Word

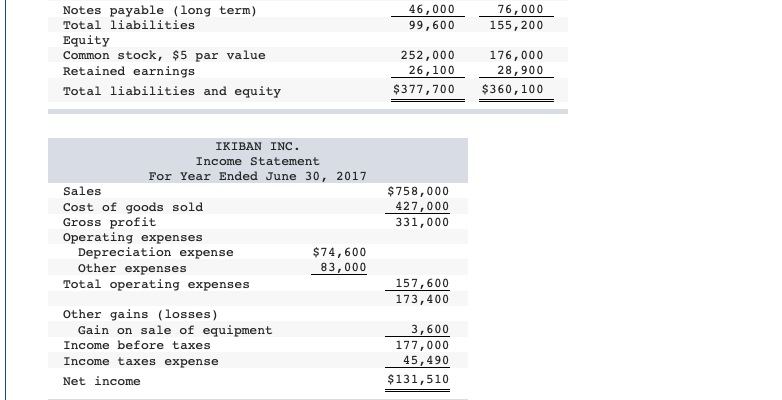

Solved 2 Compute The Company S Cash Flow On Total Assets Chegg Com

Solved 2 Compute The Company S Cash Flow On Total Assets Chegg Com

Cash Return On Assets Ratio Formula Calculator Updated 2023

What Is Cash Flow On Total Assets Ratio Definition Meaning Example

Question 15 Docx Current Ratio Quick Ration Net Working Capital To Tal Assets Ratio Cash Accounts Receivable Inventory And Course Hero

Cash Flow From Operations Ratio Formula Examples

Financial Analysis Us Gaap Example

Cash Return On Assets Ratio Formula Calculator Updated 2023

Operating Cash Flow To Total Assets

Solved 2 Compute The Company S Cash Flow On Total Assets Chegg Com